Financial Ov

ervie

w

HORSE SPORT IRELAND

Annual Report

2015

80

Horse Sport Ireland

(A company limited by guarantee)

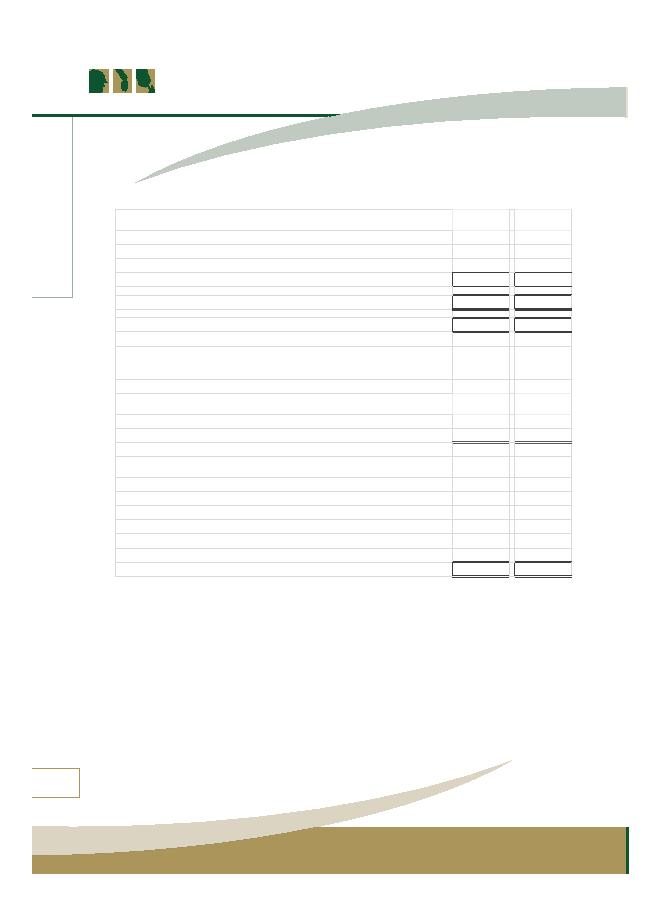

6. Taxation

2015

2014

Corporation tax

Current tax on surplus for the year

1,875

596

Adjustments in respect of previous periods

8,883

-

10,758

596

Total current tax

10,758

596

Taxation on surplus on ordinary activities

10,758

596

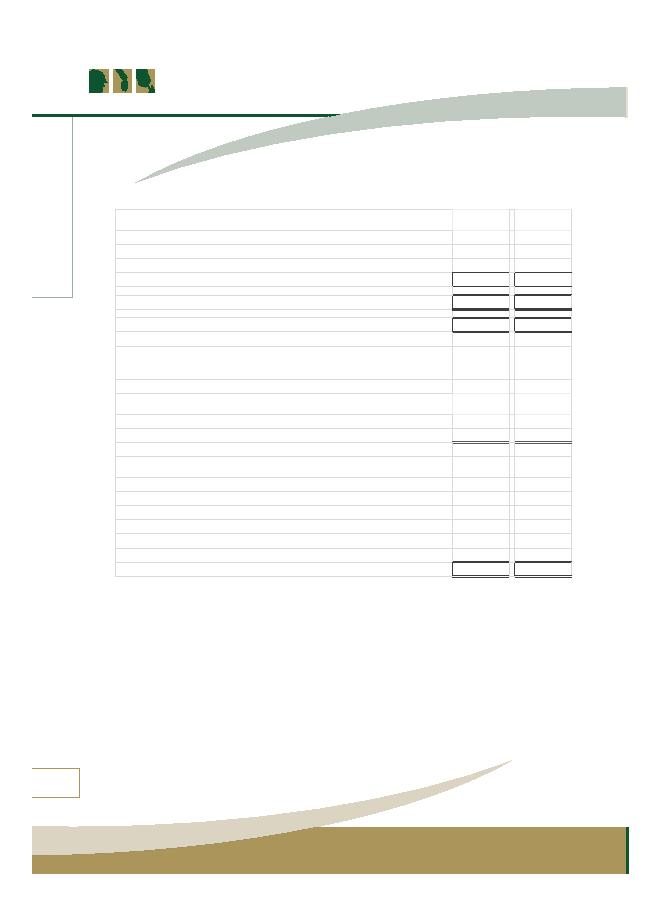

Factors a ecting tax charge for the year

The tax assessed for the year is higher than 2014 and higher than the standard rate of

corporation tax in Ireland of 12.5% (2014 -12.5%). The di erences are explained below:

2015

2014

Surplus / (deficit) on ordinary activities before tax

27,548

(100,227)

Surplus / (deficit) on ordinary activities multiplied by standard rate of

corporation tax in Ireland of 12.5% (2014 -12.5%)

3,444

(12,528)

E ects of:

Expenses not deductible for tax purposes

(274)

993

Capital allowances for year in excess of depreciation

478

(957)

Utilisation of tax losses

(1,773)

13,088

Adjustments to tax charge in respect of prior periods

8,883

-

Total tax charge for the year

10,758

596

Horse Sport_Finances.indd 80

06/12/2016 11:34